Mulund West, often hailed as the “Prince of Suburbs,” has emerged as a sought-after residential destination in Mumbai. Its strategic location, robust infrastructure, and green environs make it a preferred choice for homebuyers and investors alike. Understanding the current property rates and upcoming developments in this area is crucial for making informed investment decisions.

Mulund West Property Rates

As of 2025, the real estate market in Mulund West showcases a range of property prices influenced by factors such as location, amenities, and property specifications. Here’s an overview:

- Average Property Prices: ₹27,800 per square foot.

- Rental Yield: 3% – 5%

- Growth in Last 05 Years: 13.9%

Source: 99acres

Growth in Last One Year (Approx)

+4.5%

Location Advantage of Mulund West

Mulund West strikes the perfect balance between natural serenity and urban convenience. Here’s why the location continues to win the hearts of homeowners and investors:

Connectivity:

Situated on the Central Line of Mumbai’s suburban railway, Mulund West offers seamless access to both Navi Mumbai and South Mumbai. The upcoming Metro Line 4 is set to further reduce commute times across the city.

Upcoming Infrastructure:

- Thane-Borivali Twin Tunnel Project: This ambitious initiative involves the construction of twin tube tunnels passing beneath the Sanjay Gandhi National Park, establishing a direct link between Thane and Borivali. The 11.8-kilometer tunnel is expected to reduce the current Thane to Borivali commute by 12 kilometers, significantly cutting travel time and easing congestion on existing routes.

- Goregaon-Mulund Link Road (GMLR): Another transformative project, the GMLR aims to connect the Western Express Highway at Goregaon with the Eastern Express Highway at Mulund. Once completed, this link road is projected to reduce travel time between Goregaon and Mulund from the current 75 minutes to just 25 minutes, enhancing east-west connectivity within Mumbai.

Proximity to Commercial Hubs:

Located near to key business districts like Powai and Thane, Mulund allows professionals to enjoy shorter commutes without compromising on quality of life.

Green Lifestyle:

Flanked by the Sanjay Gandhi National Park and Yogi Hills, residents enjoy cleaner air, scenic views, and ample green cover—something rare in a city like Mumbai.

Social Infrastructure:

With reputed schools like the Finland International School, hospitals, shopping, and entertainment hubs like Viviana Mall within close proximity, Mulund West offers a self-sustained lifestyle that appeals to families and working professionals alike.

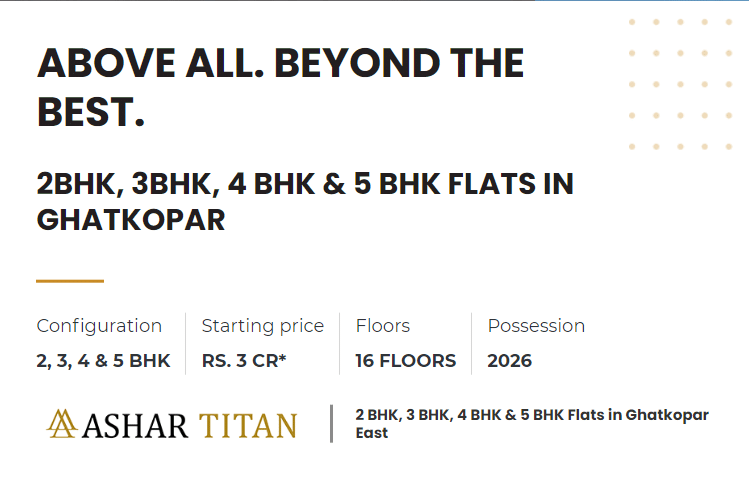

Ashar Merac: A Prime Investment Opportunity in Mulund West

Amidst the dynamic real estate landscape of Mulund Thane Corridor, Ashar Merac stands out as a premier residential project that seamlessly blends luxury, comfort, and convenience.

- Project Overview: Ashar Merac offers expansive 1, 2, and 3 BHK flats with majestic views of Yogi Hills and Sanjay Gandhi National Park (SGNP). Merac Phase 01 is nestled in a 4-acre phase of an 11-acre gated community, the project is designed by Renowned Architect Padma Bhushan Hafeez Contractor.

- Amenities: Residents can indulge in a plethora of amenities spread across a 4-level zone covering 1,10,000 sq. ft.—including a clubhouse, swimming pool, fitness center, and landscaped gardens.

- Connectivity: Strategically located near Mulund and Thane stations, Ashar Merac offers excellent access to major commercial hubs and social infrastructure.

Building upon the success of its initial phase, Ashar Group is set to launch Phase 02 of Ashar Merac.

Conclusion

Investing in Mulund West offers a unique blend of location, lifestyle, and long-term value. With landmark projects like Ashar Merac Phase 1 setting new benchmarks in residential living—and the eagerly awaited launch of Phase 02—now is an ideal time to consider this green suburb for your next home or investment.